Saudi Arabia peer-to-peer lending market is flourishing because growing technologically advanced P2P segment with added transparency over traditional banking system, affordable operating cost & low material risk, and increasing modernization of digital technologies in the BFSI sector.

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated Saudi Arabia peer-to-peer lending market size at USD 4.38 billion in 2022. During the forecast period between 2023 and 2029, BlueWeave expects Saudi Arabia peer-to-peer lending market size to grow at a Robust CAGR of 30.45% reaching a value of USD 27.96 billion by 2029. Major growth factors of Saudi Arabia peer-to-peer lending market include Increasing technologically advanced with added transparency over traditional banking system, lesser operating cost & low material risk and growing modernization of digital technologies in the BFSI sector. Since the last few decades, the money lending markets have experienced many significant developments. Due to banks’ rigorous credit rules, the money lending system is in high demand from small and medium-sized organizations (SMEs) and consumers. This drives users to P2P lending sites, which have comparatively speedier credit approval. Also, the implementation of digitalization in the banking sector increases transparency over traditional banking systems, which is projected to boost market growth. P2P lending is one of Saudi Arabia’s fastest growing fintech platforms. Religious sensitivities are the key cause for the challenges in P2P lending in Saudi Arabia. The tremendous rise of the financial sectors has attracted an increasing number of investors to this region. Banks and corporations that have previously avoided investing in Fintech are now doing so. When compared to the traditional approach, peer-to-peer lending services are more transparent and less expensive. Therefore, all these aspects are expected to boost the expansion of the overall market during the period in analysis. However, risks associated with credit and lending is anticipated to restrain market growth.

Saudi Arabia Peer-to-Peer Lending Market – Overview

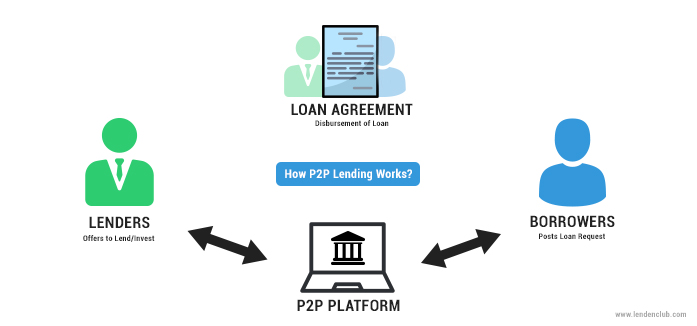

Peer-to-peer lending (P2P) is the process of lending money to individuals or businesses through online services that match lenders and borrowers. P2P services are less expensive than traditional banking institutions. As a result, lenders might earn higher returns than investors and savers offered by banks and other institutions. This money lending procedure is also known as “crowd-lending”. Even though the majority of money is provided to businesses, peer-to-peer lending is mostly an unsecured sort of personal loan. A secured loan, on the other hand, can occasionally be granted by employing grandiose assets such as jewelry, vintage automobiles, buildings, fine artworks, watches, or other company holdings. Peer-to-peer lending takes many forms, including student loans, commercial and real estate loans, payday loans, secured company loans, leasing, and factoring. P2P websites protect investors from market losses caused by overdue payments on loans by reserving funds.

Sample Request @ https://www.blueweaveconsulting.com/report/saudi-arabia-peer-to-peer-lending-market/report-sample

Impact of COVID-19 on Saudi Arabia Peer-to-Peer Lending Market

COVID 19 had a detrimental impact on Saudi Arabia peer-to-peer (P2P) lending market. P2P faced significant headwinds in 2020, necessitating a rebuilding of investor trust. The Middle East’s Fintech sector is steadily gaining traction, with the number of enterprises and investments increasing in recent years.

Saudi Arabia Peer-to-Peer Lending Market – By Loan Type

Based on loan type, Saudi Arabia peer-to-peer (P2P) lending market is divided into Consumer Credit Loans, Small Business Loans, Students Loans, and Real Estate Loans segments. The small business loans segment held the highest market share, and the trend is expected to continue in the following years. P2P lending platforms can be an excellent source of small company loans, especially for companies that do not qualify for regular bank or financial institution financing. P2P lending platforms usually have softer lending rules than traditional lenders and may be able to provide credit to small firms at cheaper interest rates. Student loans, on the other hand, are predicted to expand at the quickest CAGR owing to a growth in the number of students studying abroad.

Competitive Landscape

Major players operating in Saudi Arabia peer-to-peer (P2P) lending market include Tabby, Lendo, Raqamyah, Tammwel, Forus, Abdul Latif Jameel United Finance, Tamam, and Raya Financing Company. To further enhance their market share, these companies employ various strategies, including mergers and acquisitions, partnerships, joint ventures, license agreements, and new product launches.

The in-depth analysis of the report provides information about growth potential, upcoming trends, and statistics of Saudi Arabia Peer-to-Peer Lending Market. It also highlights the factors driving forecasts of total market size. The report promises to provide recent technology trends in Saudi Arabia Peer-to-Peer Lending Market and industry insights to help decision-makers make sound strategic decisions. Furthermore, the report also analyzes the growth drivers, challenges, and competitive dynamics of the market.

Contact Us:

BlueWeave Research Blog

Phone No: +1 866 658 6826

Email: info@blueweaveconsulting.com